When Will My Coffee Price Come Down?

Like most of our investment advisor peers, we spend a lot of time every month listening to Fed Chairman Jerome Powell trying to explain the Fed’s perspective on inflation and interest rate hikes. Since the explanations are way too circular and complicated for me, I have developed my own inflation metric, and I am trying to use it to understand what is happening with inflation. I thought I would share what I see and what I have learned.

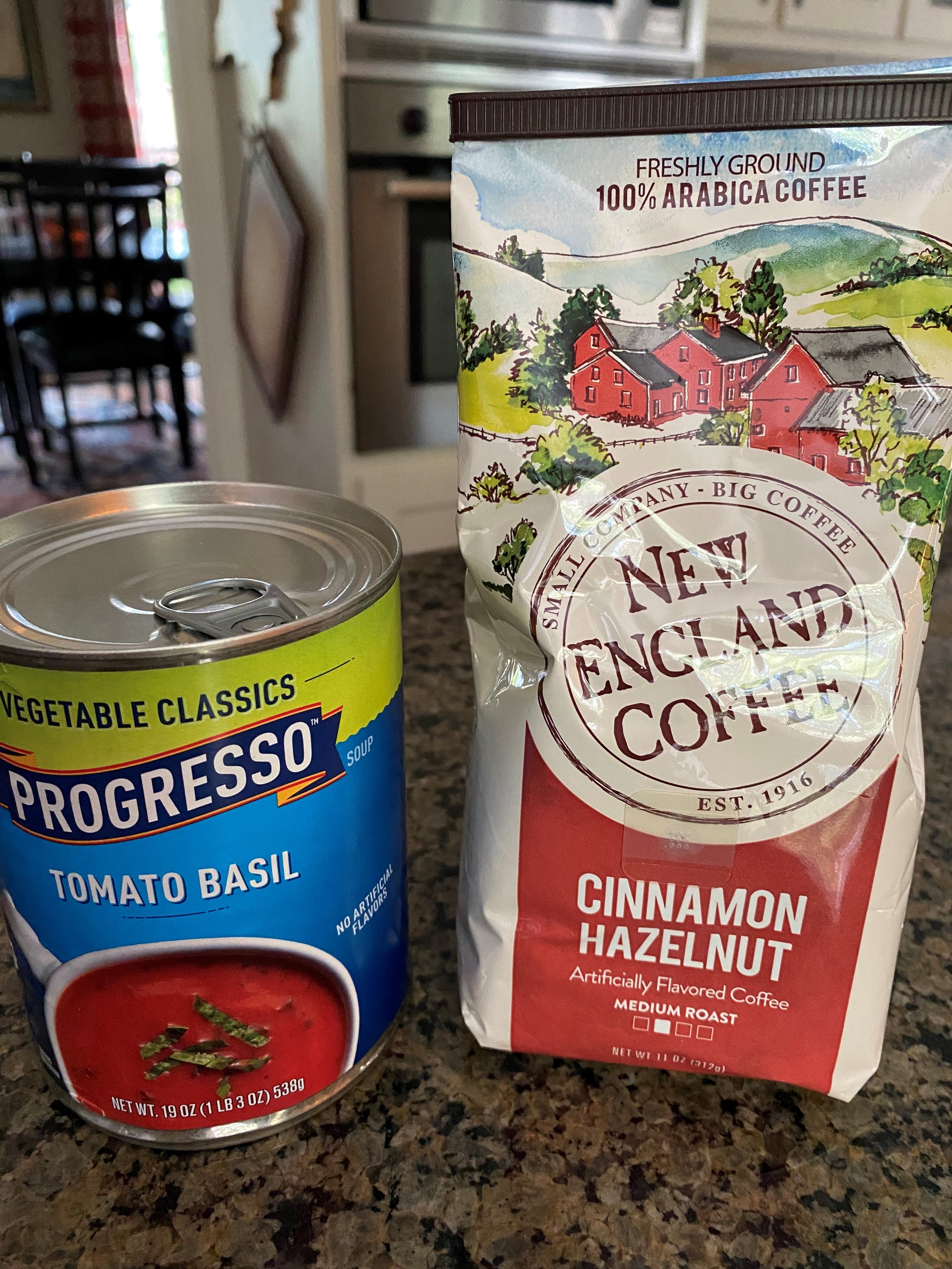

As you can see from the attached photo, I measure inflation based on the prices of these two household staples: my favorite cinnamon hazelnut coffee and a can of tomato basil soup. I know many of you will claim that my favorite cinnamon hazelnut coffee is not real coffee and that this soup tastes more like the aluminum can than like tomatoes. Both of these claims might actually be true but humor me just for the moment. The cost of this coffee has increased from $5.99/bag in 2020 to $9.99/bag in 2023. The soup which cost $1.70 in 2020 is now $3.09 per can at my local Publix. Both items are subject to occasional Buy One, Get One promotions, so I do stock up. More on this later.

Let’s start out with some simple definitions:

Inflation: a general increase in prices of goods and services; a reduction in the purchasing power of money. (ok I think we know this)

Deflation: a general decrease in prices of goods and services; the inflation rate falls below 0%. Deflation is actually quite rare and happens with a very weak economy. When companies have to reduce prices to get consumers to buy, they have to reduce their costs too. Often that results in layoffs or lower wages for employees. Unemployment, or under-employment with lower salaries, means that more people do not have the money to buy these goods and then the companies have to continue to lower prices. This is not good for the companies or for their stock prices. Deflation can lead to a recession so central banks try to act swiftly when deflation occurs. Again, this is rare in stable economies like ours.

Jerome Powell and his buddies at the Federal reserve and at central banks around the world actually want to stem inflation and deflation. Both can be very bad for the economy depending on why they happen and how quickly they come about. Does that mean I don’t really want the price of my coffee to come down because it means the economy might be bad? Not sure I’m there yet.

So what do we actually want to see happen to prices? The answer is a much less well-understood term that we hardly ever talk about - disinflation.

Disinflation: inflation rate falls but it remains positive; prices continue to rise but at a slower rate. This is the current and healthy scenario which prevents the economy from overheating or underheating. Inflation at 2-3% is much lower than the 9% peak in 2022 but it is nowhere near the 0% or lower rate we saw in mid-2020. It is still painful, however.

Ok so now that we know the big picture economic goal is not actually for deflation, what do I want for my coffee and soup prices? In truth, the prices have been very stable for the last six months and have not budged a penny in either direction. I keep waiting for the prices to come down so that I can confidently declare that inflation is getting better – and that the bonds in our portfolios will start to rebound. But maybe my goal is wrong, and for the sake of the broader economy, I should be happy that the prices are not going up. I’m trying, but it sure feels like someone other than me is coming out way ahead here!