Bernie’s Blog

Is the Recent Stock Market Volatility Making You Dizzy?

Us too! Here’s how we cope – feel free to join us in person or virtually…

Alright, now for a little fun and a little perspective…..

Today is Oct 11, 2021. The last time we actually posted a photo like this one on Bernie’s Blog was Oct 11, 2018, three years ago today! Hm…. In that photo, we actually had CNBC on the TV in the background so we could see that the Dow that day was 25,572. Right now, the Dow is at 34,532. That’s a 35% gain in the last three years.

And as painful as the last month has been on many days, let’s remind ourselves of just how good the market has been even year to date. As the chart below shows, the S&P 500 is up 17% YTD!

So, what do we recommend:- Don’t panic or make sudden market moves. Turn off the TV and don’t look at the market. We are looking at both and we will let you know individually if you need to know something or do something.

- Re-look at, and recommit to, having a healthy cash reserve to cover planned and unplanned expenses for the next year to 18 months. As your life changes, so does your cash reserve need, so this is a good time to ensure that you have this cash readily available. We recommend a high yield savings account for this money. We can help you locate one and set it up if needed.

- If you still have some extra cash in those coffee cans in your backyard after boosting your cash reserve, now might be a good time to begin to dig it out to invest Will the market go down? Yep. Will it also go up? Yep. As usual, buying stocks a little at a time is the right strategy here. As many of you have experienced, this is the best way to build long term wealth.

We are here to talk, whine or wine with you!

Are Retirement Plan Changes on the Way?

It’s Tim here, blogging once again about one of my favorite topics….

Once again, Congress is “looking” at regarding changes to retirement savings plans. No one knows what will actually pass.

Reportedly under discussion:

- Raising the age of taking Required Minimum Distributions (RMDs) from 72 to 75. This would be done over a 2-to-3-year period.

- Letting people over 60 contribute more to 401Ks.

- Allowing part time workers to contribute to 401Ks

- A revenue raising proposal to reduce the amount of pretax pay into 401K’s. This bipartisan house bill would require that catch-up contributions to workplace qualified retirement plans would be subject to Roth treatment. This means that the extra $6500 contributed by workers who are 50 or older would automatically go into a Roth 401K and come from post-tax salary rather than pre-tax wages. Another provision would provide the option of having employer matching contributions put into a Roth 401K account. This raises tax revenues today to pay for other retirement savings measures. This may not be a bad thing.

- Ideas to limit Roth IRA benefits for high income earners are back on the table. The 2016 proposal prohibited contributions to Roth IRAs with balances over $5MM. It also called for limiting high earning individuals from making after tax deposits into traditional IRAs and then converting them over to Roths. Both proposals were pushed by Sen. Ron Wyden (D-OR) who now heads the Senate Finance Com., which is the tax writing committee for the upper chamber. As of 2019, 28,615 individuals had $5MM or more in their IRAs (this compares to 8,000 in 2011). Of these 497 have over $25MM or more.

Stay tuned!

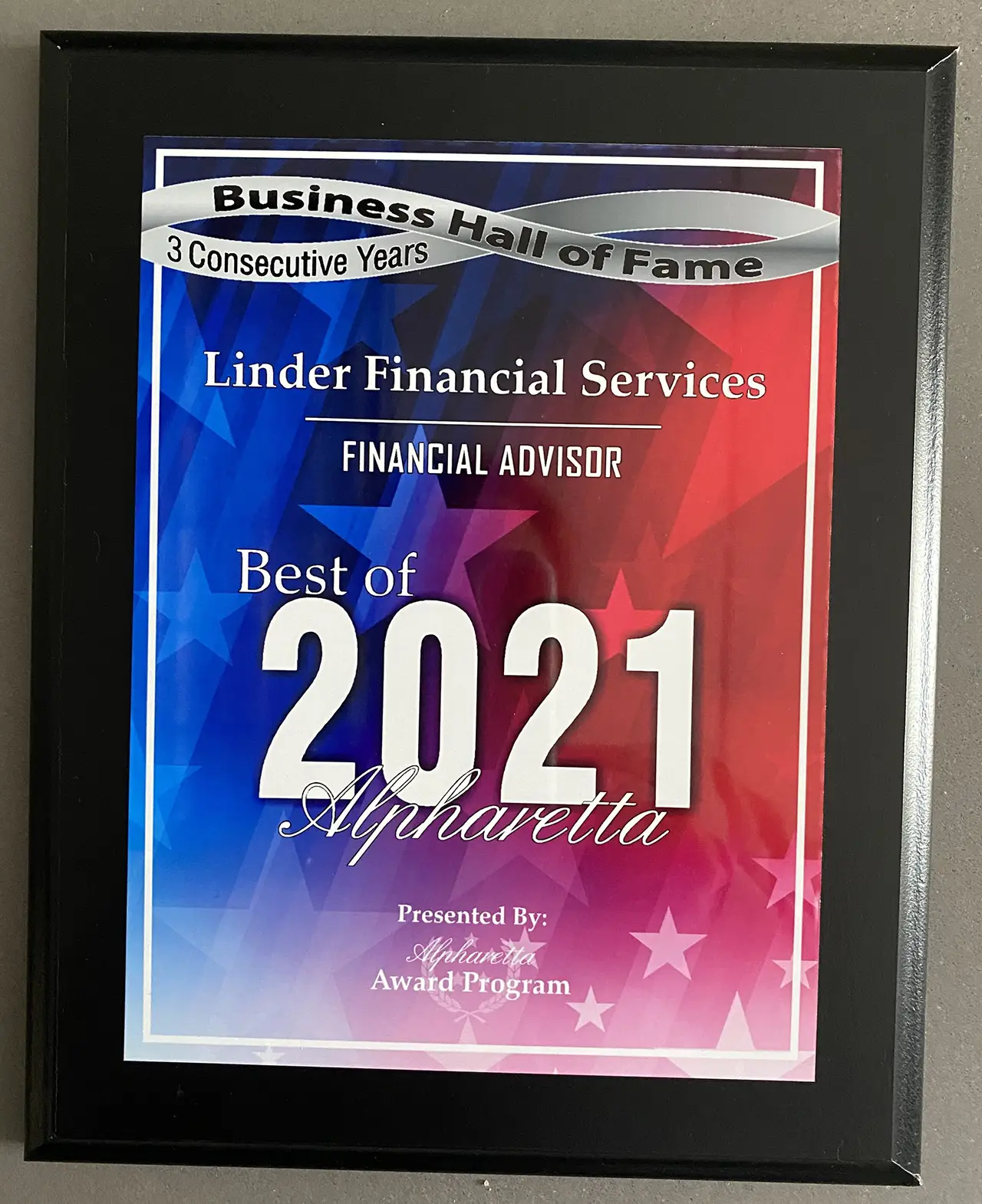

Linder Financial Services Receives 3rd Straight Best of Alpharetta Award

Press Release

FOR IMMEDIATE RELEASE

Linder Financial Services Receives 2021 Best of Alpharetta Award

Alpharetta Award Program Honors the Achievement

ALPHARETTA July 27, 2021 — Linder Financial Services has been selected for the 2021 Best of Alpharetta Award in the Financial Advisor category by the Alpharetta Award Program.

Each year, the Alpharetta Award Program identifies companies that we believe have achieved exceptional marketing success in their local community and business category. These are local companies that enhance the positive image of small business through service to their customers and our community. These exceptional companies help make the Alpharetta area a great place to live, work and play.

Various sources of information were gathered and analyzed to choose the winners in each category. The 2021 Alpharetta Award Program focuses on quality, not quantity. Winners are determined based on the information gathered both internally by the Alpharetta Award Program and data provided by third parties.

About Alpharetta Award Program

The Alpharetta Award Program is an annual awards program honoring the achievements and accomplishments of local businesses throughout the Alpharetta area. Recognition is given to those companies that have shown the ability to use their best practices and implemented programs to generate competitive advantages and long-term value.

The Alpharetta Award Program was established to recognize the best of local businesses in our community. Our organization works exclusively with local business owners, trade groups, professional associations and other business advertising and marketing groups. Our mission is to recognize the small business community’s contributions to the U.S. economy.

SOURCE: Alpharetta Award Program

CONTACT:

Alpharetta Award Program

Email: PublicRelations@online-award-info2021.net

URL: http://www.online-award-info2021.net

My Summer Internship at LFS

Hello there! There’s a new face around the LFS offices, and it’s the person writing this blog post! My name is Avra, and I’m a summer intern for Linder Financial Services. The past few weeks, I’ve been doing some behind-the-scenes work at LFS, including learning the ropes, assisting with clerical work, and doing some research of my own.

When I was offered the intern position at LFS, I’ll admit, I was a bit nervous. I was alright in the math department, but finance was completely new to me— they don’t offer Economics classes to high school sophomores! I’d heard snatches of conversation between my parents about a “Roth” and a “401(k)”, but apart from that, everything flew right over my head.

Enter LFS. On my first day, I found a schedule on my desk, with five full weeks of learning and research ahead of me. And research I did—among conducting interviews, investigating companies to invest in for my own Roth IRA, practicing my elevator pitch, and designing projects, I took several pages of notes, referenced and cross-referenced sources, and accumulated quite a large bibliography. Turns out that the world of finance is a little more complicated than I thought! I did get to mix a bit of fun in with my work via designing and painting the LFS holiday card (look out for something new in December!), and creating an auction board for the Country Club of Roswell’s charity fundraiser. Overall, speaking from week five, I can gladly look back and say that the experience was worth it. It’s always nice to have useful information under your belt, and I’m excited to share with you all what I’m going to use it for!

My main project while interning has been to design an informative guide focused on teen investment, so that I can pass along the information I’ve learned during my time at LFS. Over the summer, I noticed that many of my friends got hired for jobs, and regardless of if they were employed at small businesses or doing volunteer work, the end result was often money. And what do you do with that? To make a long story short— they wanted to know. When I broached the idea of a guide to them, I was excited to see that many of them had lots of questions, so I was even more eager to dig deeper in my research. My efforts resulted in the creation of a Carrd— a website platform that allows you to create easy-to-use interactive infographics. Over the past year, Carrd has gained a notable amount of popularity in terms of usage for its accessible design and layout, so I thought it fitting to use for my fellow tech-savvy peers. (Don’t worry, Carrd can still be accessible to you if you aren’t well-versed with technology!) It’s packed with the basic need-to-knows about investment, and I can’t wait to share it with you all (if you’re interested, of course). And while I’ll be leaving soon to head back to school, it’ll coming to a blog near you…

Mid-Summer: Time for Contact Info Clean-Up at Ameritrade

As most of you know, everything at Ameritrade is tied to your mailing address, phone number and/or email address. If everything is current, Ameritrade is just slow and sometimes makes mistakes. Kinda like us. If these items are not current, it is nearly impossible to get anything done there, especially if it’s an urgent request. These Ameritrade requirements are for our security as account holders, so this is all good!

We took a quick look at our own family accounts and realized that some members of our family (not to name names, Mom and Dad) have been woefully negligent in updating these items. So, while we are cleaning up our own family info, we want to work with you on yours over the next few months. We realize that many of you have moved recently due to record low interest rates, have changed your email addresses or gotten rid of your home phones.

So how are we going to do this?

We have a CRM (customer relationship management) system which allows us to keep track of all of this client information – and we think it’s mostly accurate because your birthday cards don’t usually come back to us, but our system doesn’t update Ameritrade (again for security reasons). So, expect that this process will be a little manual. We will tell you what Ameritrade is showing and what our system has. If you tell us that any of this is wrong, we will send you any appropriate paperwork to change it at Ameritrade. Some info can also be updated via Advisor. Client.

HINT: We are now frequently using DocuSign for online form approval, when it is available, and you are comfortable using it. This process requires you to answer obscure security questions (what color was your car in 2005?) or uses double factor authentication via text to the cell phone number on record at Ameritrade. If you do not have a cell phone number on file at Ameritrade, this is a good time to add it, even if you don’t plan to text. They can then call you to give you the code.

Just think of this as summer cleaning….

World Elder Abuse Awareness Month

Oops, we almost missed this but because it’s so important, we are going to extend June for another few days!

World Elder Abuse Awareness Month was started in 2006 to combat the six types of global elder abuse. Financial mistreatment of the elderly is actually the most common and fastest growing type of elder abuse around the world.

What exactly is elder financial abuse?

The Older Americans Act of 2006 defines “elder financial abuse” as “the fraudulent or otherwise illegal, unauthorized, or improper act or process of an individual, including a caregiver or fiduciary, that uses the resources of an older individual for monetary or personal benefit, profit or gain, that results in depriving an older individual of rightful access to, or use of, benefits, resources, belongings or assets.”

I know many of us are saying “well yes, but that can’t/won’t happen to me or my parents.” We hope we are right about that, but AARP says that the victims of just investment fraud are most likely married men with higher incomes and greater financial literacy than average. That sounds like a lot of us, and our fathers! And even more scary, as much as 90% of overall elder financial mistreatment is done by relatives or other trusted caregivers. Retirees are often targeted just because of their wealth. And only 1 in 6 cases is reported. And in case you are wondering, we have absolutely had clients who have been the victims of elder financial abuse.

What are the signs of elder financial abuse?

The experts tell us to watch for in our loved ones:

- Uncharacteristic purchases or money transfers. As you know, we look at every Ameritrade transaction every day and we call you if we see something that doesn’t look like you.

- Failure to pay bills or keep appointments. This can sometimes be elder abuse and sometimes be forgetfulness or something else, of course

- Secretive transactions or unwillingness to discuss financial behaviors

What should I do if I’m the victim of financial abuse?

- Report to Adult Protective Services in your county

- Notify local police department

- Tell us, and your other loved ones