Bernie’s Blog

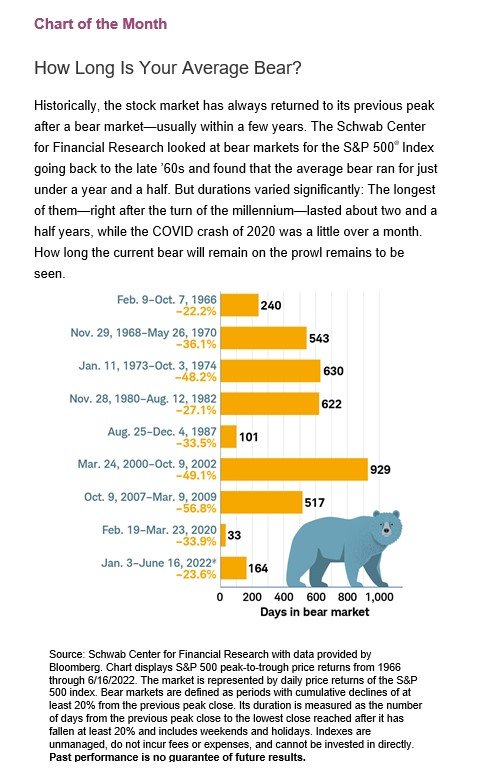

How Long Do Bear Markets Usually Last?

We are asking ourselves this question so you might be too. The answer is “too long” of course.

We like this chart from Schwab which provides a historical perspective, which of course means nothing about the current situation – except that bear markets have ended 100% of the time they have happened in the past!

Two More Inflation Fighting Ideas

After you have purchased I Bonds (you can still do, and we can help!) we want to share two more ideas!

Stock up on stamps and run low on gasoline. We are…

What’s Going on With Transition from TD Ameritrade to Schwab?

We ask ourselves this question nearly every day so some of you are probably ready for an update too.

As a reminder, in 2019 Schwab announced that it was acquiring TD Ameritrade. The deal actually closed in October 2020 with the implementation timeline expected to be 30 to 36 months from that point. As you may remember, the news at that time was that both companies would continue to operate as largely separate entities until the transition was complete. Schwab is now confirming that the actual conversion is expected to be on schedule – sometime between April and September 2023.

What have we experienced so far?

Both Schwab and Ameritrade realize how complicated this transition is – for them, for us and for you. They are committed to minimizing the disruption for all of us while delivering a customer experience and platform which is better than what we have now. Both companies are committed to getting the conversion right the first time – for advisors and for clients. All good to hear. Thus far, we see great commitment, communication, and lots of testing, but we recognize the heavy lifting ahead.

As many of you know, we signed up for the Schwab “jumpstart” program which allows TD Ameritrade advisors an opportunity to get an earlier look at and experience using the Schwab platform. We did this so we will not be on our Day 1 while you are on your Day 1! We moved a handful of our personal accounts (lots of paperwork to do!), absorbed a few onboarding sessions and then jumped into “learning by doing.” See attached photo of Marci “learning by doing.” You will be happy to know to know that at least so far, we haven’t messed anything up badly enough that we couldn’t undo and redo – although there has been a fair amount of undoing and redoing. Not a problem.

There are a few things we have already seen which we really like:

- The client interface (called Schwab Alliance) which will replace TD Advisor Client is easy to use and the mobile experience is much improved. The security has been upgraded and some features which were not available on TD Ameritrade’s mobile platform will be available on Schwab’s. That’s good.

- Schwab doesn’t allow DocuSign as much as TDA does (not sure THAT is such a bad thing) but they do have an electronic signature process via Schwab Alliance which is easy to use and doesn’t require clients to remember the car they owned in 1967. This is good too!

- The phone support has been excellent – and we have needed it.

What have we been told will happen, but we have not seen yet?

- There will be no need for any paperwork for account transfer from TD Ameritrade to Schwab unless accounts are moved before the official transition date. Spoiler alert – we will want to continue to build our Schwab experience in the next year so we will want to move some additional client accounts but we will do the paperwork as usual so you will not have to do. Let us know if you want to be early adopter.

- Existing account and advisor authorizations which are on the Ameritrade platform (trading authorization, fee deductions, option trading, electronic statement delivery, etc) will be carried over to Schwab.

- Most account history will be transferred over. We also have all of your LFS quarterly updates since you joined our LFS family.

- Some of the beneficiary info will have to be updated after the transfer.

- There are likely hundreds of questions we haven’t even though of yet!

What do we need to do with you over the next 9 to 15 months? We will take the lead here!

- Data clean-up. Since most information will be directly transferred, we can all help by ensuring that what we transfer is up to date. That includes mailing and email addresses, phone numbers etc. We will also want to close any account which are not funded. We can always re-open those at Schwab if they are needed.

- Where possible, we want to update any automatic transfer instructions between your Ameritrade accounts and your checking account to “pull” from Ameritrade rather than “push” from Bank of America (for example). These transfer instructions will then automatically migrate to Schwab. If that can’t happen, it’s fine – we will just have to redo those after the conversion with your new Schwab account info.

- We have been told that this transition will be much easier if clients have an active Advisor Client account at Ameritrade. We know that some of you do not use Advisor Client but for those of you that do, we will want to ensure that your access is up to date.

Let us know what questions you have so far! We have time to get this work done with you way ahead of the actual transition.

I Bonds… I Bonds… I Bonds… I Bonds

Most of you have probably heard of I Bonds by now, either from us or from your favorite media personality. Let’s talk about what these actually are and who can benefit. Spoiler alert, if you are reading this, you can most likely benefit!

What is an I Bond and how does it differ from a TIP?

I Bonds are inflation adjusted 30-year U.S. savings bonds. The inflation adjustment happens twice per year and is based on the Consumer Price Index (CPI). From now until October, the annual variable interest rate (coupon) is 9.62%. No really, 9.62%. These are U.S. treasuries so 100% safe, the actual value of the bond does not fluctuate, and the interest is added to the bond value every six months. These bonds are also tax efficient because the interest is only subject to Federal income taxes and only when the bond matures or is sold.

Since many of you own TIPs (Treasury Inflation Adjusted Notes), you are undoubtedly asking yourself if these are different. The answer is that they are different in some important ways, but they complement each other perfectly. First of all, for a TIP, the coupon rate stays constant throughout the bond life but the principal amount on which the coupon rate is applied is adjusted twice per year, based on the CPI. TIPs are great for long term inflation protection, and we like them, especially in IRA’s because the TIP interest and inflation adjustment are taxed every year at your full tax rate. There is also no dollar limit on TIP purchases, and you can own TIPs in your Ameritrade accounts and sell them at any time.

Are I Bonds too good to be true?

I Bonds are not too good to be true BUT there are some important limitations:

- Each person can only purchase $10K in electronic I Bonds each year. There are no income or age limitations. They can also be purchased for children (and grandchildren!). Minors can own I Bonds but they can’t have their own Treasurydirect account.

- These must be purchased via the Treasurydirect website and held at the Treasury. The account set up and purchase is a bit of a clunky process, but we can help you. I Bonds cannot be owned in brokerage accounts or IRA’s or your bank.

- These bonds must be held for at least 12 months. If they are sold between 1 and 5 years, there is an interest penalty of three months. I Bonds will earn interest for up to 30 years, but obviously when inflation moderates, they will become less attractive.

- Each I Bond can have only one beneficiary.

Are I Bonds for me and how do I get started?

In general, I Bonds are for you, as long as you have enough cash remaining in your cash reserve after the purchase to sustain you for at least one year, and preferably 5 years. We will discuss individually with you this quarter but feel free to call if you want to discuss now. Obviously, the sooner you purchase, the more interest you will earn!

As I said above, the process is a little clunky with a lot of information, multiple passcodes/security questions and double factor authentication required. Because these are not held at Ameritrade, our normal “do for you with your approval” process does not work. We have developed a form for you to use on your own so that you have all the info you need in front of you when you begin the process, and we are also happy to undertake a “do with you” process to open the account and buy these I Bonds.

Happy to answer questions and to help!

Why are Gasoline Prices Still Going Up… and When Will They Come Down?

As all of us who drive and/or absorb news know, gasoline prices are painfully high and seem to be getting higher by the hour. Why is that and when will it end?

First of all, we are right, we are paying more, well let’s just call it what it is, a lot more for gasoline right now. Today, the national average for regular unleaded gas is about $4.60, up 40% from $3.28 at the start of 2022 and 51% higher than the $3.04 national average a year ago. Clearly, there are a number of reasons for the increase, which means the “why” question is hard to answer. But what is clear is that no one person, company, or government controls gas prices, which also means no one person, company, or government can fix this mess.

Reason 1: Covid caused serious pain for global oil in 2020 and this large and slow-moving market has just not yet recovered. As you may remember (or you can go back and read Bernie’s Blog) oil prices dropped precipitously seemingly overnight, as millions of people around the world sheltered in their homes whenever they could. There was a time in April 2020 when benchmark world oil prices were actually negative. Physical oil reserves filled rapidly, and energy producers/OPEC nations drastically cut production due to the really low prices. So now if we fast forward to 2022, oil demand is almost to pre-pandemic levels, but the supply has not been built back up yet – a slow process. Not to mention that much of the least cost-effective production was permanently shut down over the last two years. Oil companies are just not anxious to dig new wells because oil pricing is so volatile. And let’s be honest, the oil companies and their investors are pretty happy with status quo. Just take a quick look at your energy holdings….. the only holdings we are actually encouraging you to look at!

Reason 2: Besides the financial disincentive to dig new wells, there is growing support around the world to replace fossil fuels with more carbon neutral alternatives. This support and public debate have made future oil drilling even more challenging, especially in a mid-term election year.

Reason 3: The war in Ukraine has resulted in sanctions against and voluntary import stops of Russian oil. Prior to February, Russia supplied 10% of the world’s oil, albeit a much larger percentage in Europe than in the U.S. The reliance on Russian oil can be reduced but it takes time and money to do – with financial pain for all.

So now the question we all have… when do gas prices come down for real? It doesn’t feel like the three factors above, which largely impact oil supply, are going to improve markedly anytime soon, which means a demand change will be required. That demand change is most likely to come about with higher interest rates and slower economic growth, which come with their own set of challenges, as we all know. Not an easy problem to solve. We can add it to the list of hard problems to solve.

An Explainer: Just What is Happening with Bond Prices?

For those of you who are continuing to look at your statements, despite our advice to the contrary, you have undoubtedly noticed that your bond and bond fund prices are falling. We all know that bond prices fall as interest rates go up but what does that really mean and what should we, as investors, do about it?

First of all, experts have expected interest rates to increase for 15 years, so the fact that that is now happening is not a surprise. What is a surprise is the speed with which it has happened. But of course, we are also now experiencing unprecedented inflation. Bonds are still a critical part of our portfolios to provide generally “non-correlating” performance with equities and to provide income and lower volatility – usually. But bonds are not a great inflation hedge – which is why we usually recommend TIP’s which have lower coupons but better overall yield when inflation is increasing.

- If you own single bonds, remember that the day-to-day fluctuations of bond prices (as ugly as they can be) do not impact the face value redemption price at maturity. And interest continues to be paid until the day the bond is sold or matures. If you own Treasury Bonds (including TIPs of course) the default risk is really non-existent.

- If you own shares of a bond fund, your share price has been declining, rapidly. But the monthly interest payments are still intact, and as bonds mature in the fund, they will be redeemed at face value and replaced with higher-paying (or higher-yielding) bonds. That eventually helps the overall investment to recover. The replacement of the existing bonds in the fund obviously happens more quickly if the fund owns shorter duration (time to maturity) bonds. Think Vanguard Short Term Bond Fund. Over time, the re-invested dividends will compensate for the decline in price, but this does not happen immediately.

In this period of bond price volatility, one strategy we are starting to selectively pursue is using a TIP fund instead of single TIPs. The fund manager of the TIP fund buys multiple duration TIPs within the fund to better manage the interest rate risk. This is a discussion topic with many of you as we talk over the next quarter.