Bernie’s Blog

It’s WEDDING SEASON at LFS – Part 1!

Congratulations to Bradley and Maayan, Marci and Howard, and Linder grandparents. Photos from beautiful ceremony in Providence, Rhode Island are attached.

We are so happy to welcome Maayan to our family! Marci and Howard are grateful to all of you for the notes and texts – they will be back in touch soon!

The Financial Impact of the Olympic Games

As I am enjoying a much-needed replacement of my usual non-stop news coverage with Olympic swimming, skateboarding and soccer, I can’t help but wonder if anyone makes any money from all of this. Interesting question with the expected answer, which I am sharing below.

The answer is not really.

Historically, the average $10 billion needed to host the summer games has dealt a financial and environmental blow to the host city/country. The construction of temporary infrastructure, promised to aid the host city for the following decades, has rarely delivered on that commitment. The likely cost overruns, coupled with the potential environmental impact, has made it increasingly difficult to convince cities and countries to host these games. The notable exception to the negative financial impact was the 1984 Summer Games in Los Angeles, which delivered a $200 million surplus, largely by using existing infrastructure and offering valuable sponsorships and broadcast rights. Los Angeles will again host the summer Olympics in 2028, although some of the events will be held as far away as Oklahoma City! I will say that financial considerations aside, we really enjoyed the 1996 Summer Olympics here in Atlanta!

Now what about 2024 host city Paris? The International Olympic Committee (IOC) and Paris hope to reverse both the negative press and the historically negative financial and environmental trends. These are valiant efforts for sure but it’s way too early to assess the results. Critics insist that changing the financial and environmental trajectory will require a vastly different athlete and fan experience, with the likely need for permanent or a small rotation of host cities/countries. Since that’s not happening for the foreseeable future, let’s have a look at some of the numbers.

- 5 of the last 6 Olympic games have had cost overruns of at least 100%. And experts claim that some of the actual costs have not been included in the analyses. Many of the eventual host countries also invested $100 million in their bids to secure the Games.

- Summer Olympic games are almost double the cost of winter Olympic games.

- The current cost estimate for the Paris Olympic and Paralympic Games is $9.7 billion which is 25% over the initial bid from 7 years ago. Officials cite this little factor called inflation. Yep.

- Paris already had many sports venues so the plan was to limit new construction to the Olympic Village which will presumably become mixed-income housing later, an aquatics venue and a small arena. Not included in the $9.7 billion estimate was the $1.5 Billion to make the Seine clean enough to swim in, because presumably that was to be done regardless. Still remains to be seen how that will work out.

- There have already been 8.6 million tickets sold for the events in France (not sure if that includes tickets for the surfing in Tahiti) but early reports suggest fewer than expected visitors – with the expected negative impact on airlines, hotels, and restaurants. Paris is also apparently considered a prime tourist destination, so a long- term tourism boost is less likely.

My conclusion – I sure love to watch these events, even though I still cannot understand rugby, but not sure there is a strong financial proposition here. Happy viewing!

Elections and the Stock Market – no politics, just fun…

As promised, it’s time for some data and fun historical facts on the stock market before and after a Presidential election. This is a politics-free zone, so read on!

Let’s look first at what has historically happened to the stock market during Presidential election years and then what happens after the election, depending on which party wins. Spoiler alert….. it doesn’t really matter.

Now here is a shocker, election years tend to be volatile but in general, the market goes up. Remember though that there have only been 18 Presidential election years since 1952 so there is limited data. And let’s remember that in general over time, markets go up or none of us would be doing this. The S&P 500 has averaged a 7% gain in the election years since 1952 which is short of the 10% average gain in all years, but there has not been a down election year during this time. However, “re-election” years, which this clearly is, have delivered a better 12.2% gain since 1952. We all know that past market performance is no guarantee, but I like our odds given the performance already this year.

Now for some interesting election year data:

- Top sectors in presidential election years since 1952: energy and financial services

- Bottom sectors in presidential election years since 1952: materials and technology (hm?)

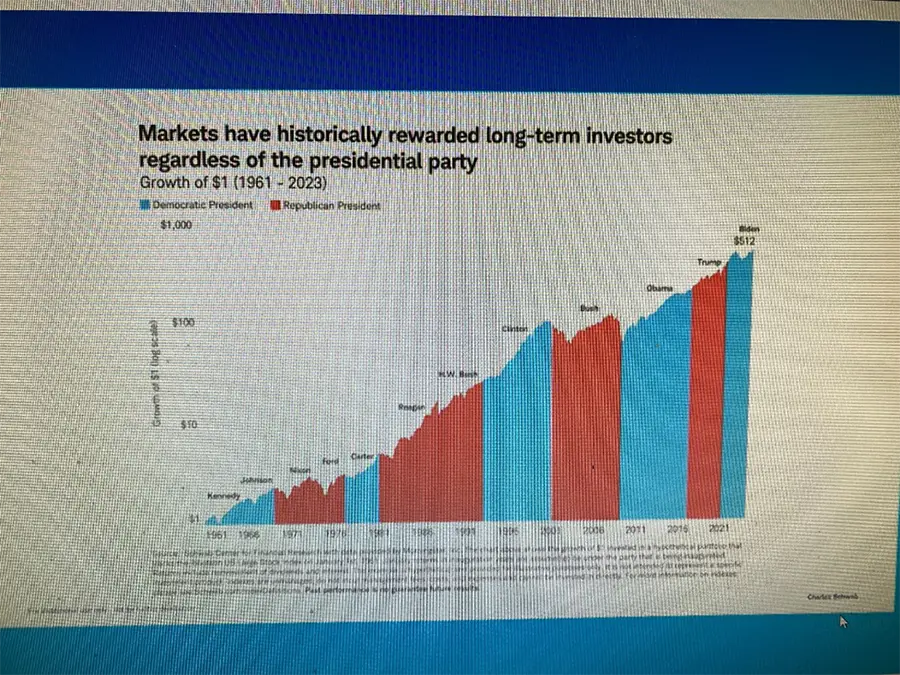

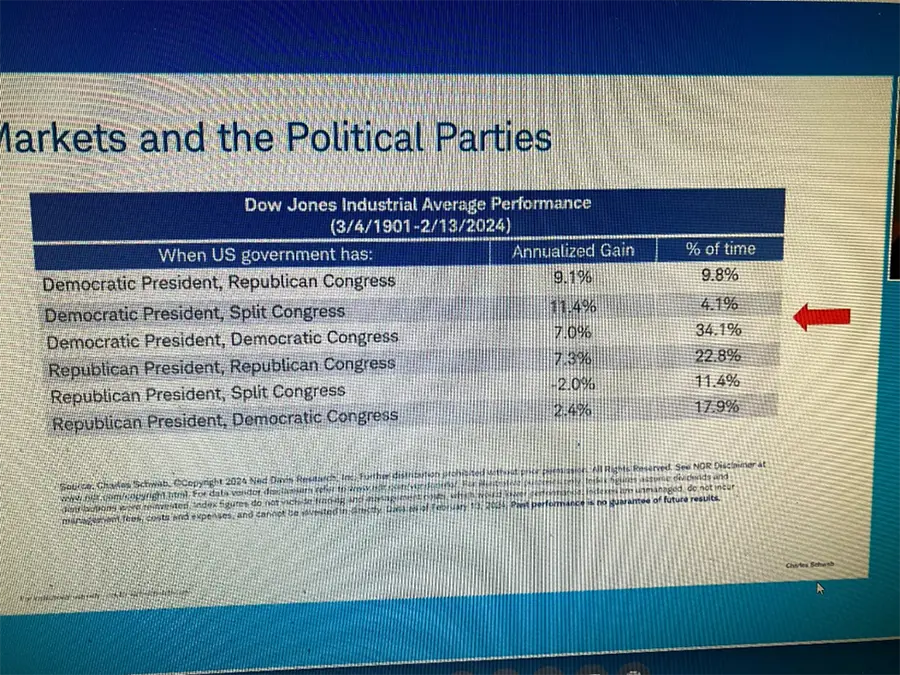

Now what happens after the election? In general, markets go up, regardless of which party wins the White House. And although I love the Schwab chart below which shows the market performance depending on the party of the President and Congress, my conclusion is that there is really no conclusion – in other words, there are other far more important factors which influence what the market does. But might be good Independence Day, Labor Day, and Thanksgiving party conversations anyway!

Linder Financial Services Named “Best of Alpharetta” for 6th Consecutive Year

FOR IMMEDIATE RELEASE

Linder Financial Services Receives 2024 Best of Alpharetta Award

Alpharetta Award Program Honors the Achievement

ALPHARETTA March 2024 — Linder Financial Services has been selected for the 2024 Best of Alpharetta Award in the Financial Advisor category by the Alpharetta Award Program.

Each year, the Alpharetta Award Program identifies companies that we believe have achieved exceptional marketing success in their local community and business category. These are local companies that enhance the positive image of small business through service to their customers and our community. These exceptional companies help make the Alpharetta area a great place to live, work and play.

Various sources of information were gathered and analyzed to choose the winners in each category. The 2024 Alpharetta Award Program focuses on quality, not quantity. Winners are determined based on the information gathered both internally by the Alpharetta Award Program and data provided by third parties.

About Alpharetta Award Program

The Alpharetta Award Program is an annual awards program honoring the achievements and accomplishments of local businesses throughout the Alpharetta area. Recognition is given to those companies that have shown the ability to use their best practices and implemented programs to generate competitive advantages and long-term value.

The Alpharetta Award Program was established to recognize the best of local businesses in our community. Our organization works exclusively with local business owners, trade groups, professional associations and other business advertising and marketing groups. Our mission is to recognize the small business community’s contributions to the U.S. economy.

SOURCE: Alpharetta Award Program

Yay! April is Financial Literacy Month

We know most of you are not quite as excited as we are about the 21st annual Financial Literacy Month, but we know you are excited about our annual financial literacy quiz!

As a reminder, Financial Literacy Month was created to build awareness of smart money habits, including budgeting, saving, spending, and investing.

Now to the quiz:

1. Which of the following assets would be expected to hold value during a period of inflation?

a. A certificate of deposit

b. A corporate bond

c. A house

d. This is a dumb question because we never have inflation.

e. No idea. Guess I better call LFS.2. Which of the following investment strategies has historically shown the highest return over several years?

a. Avoiding the stock market entirely and keeping cash in a FDIC insured savings account.

b. Moving money in and out of stocks frequently to avoid downturns and take advantage of upturns.

c. Buying and holding a variety of stocks while largely ignoring short term fluctuations.

d. This is a dumb question because the stock market never has downturns or upturns.

e. No idea. Guess I better call LFS.3. A 15-year mortgage usually has higher monthly payments than a 30- year mortgage on the same property. The total interest paid over the life of the loan is

a. More for a 15-year mortgage than a 30-year mortgage

b. Less for a 15-year mortgage than a 30-year mortgage

c. Exactly the same interest regardless

d. Too much

e. No idea. Guess I better call LFS.4. When GE stock split earlier this month, why did I get some cash in my account?

a. GE paid me to take some shares in the new company.

b. A dividend was paid in cash right after the split.

c. GE paid cash for my fractional GE Aerospace share instead of issuing a partial share of GE Verona

d. It doesn’t matter because I already spent both dollars GE gave me.

e. No idea. Guess I better call LFS.5. What should I do if I get a website link in an email from Schwab that I have not been told about by LFS? Or if Schwab calls me?

a. Do not click on the link or call Schwab. Call LFS immediately.

b. Do not click on the link or call Schwab. Call LFS immediately.

c. Do not click on the link or call Schwab. Call LFS immediately.

d. Do not click on the link or call Schwab. Call LFS immediately.

e. Got it?Spoofed Website Scams, which may impact Schwab

There is a growing concern about “spoofed” websites which are designed to convince users that they are visiting legitimate sites. Some of you have reported this huge concern to us with links from Schwab which are not actually from Schwab. Because of the reports from account holders, Schwab has provided some information and talking points for advisors to share with clients. We have also gotten reports of fake emails with links which look like they are from us.

How this happens:

Potential fraudsters purchase “sponsored links” to fake websites which appear at the top of search results. They hope that we, as unsuspecting potential victims, will click on these links and be directed to these fake websites where we could be exposed to malware or asked to provide confidential information.

What we all need to do, for all website links, not just for Schwab links

- Watch for URL errors, including misspellings, grammar/format errors or unusual website domains. Even one letter out of place is a signal that something is likely amiss. The fake emails from us have originated from fake email addresses. Check that.

- When you click on the site link, you are notified of a login issue and often directed to a hotline phone number. There may be a mention of unauthorized account activity. Remember that Schwab will never ask you over the phone for your account login password so if someone asks you for that, do not provide it. Obviously, we will never ask you for passwords in email or on the phone either.

- Question anything from Schwab which looks like an attempt to create a sense of urgency. Call us right away before you act.

Additional steps we are taking:

- As you know, we look at all account activity every day in every account so we will track you down if we see something unexpected – that we didn’t talk about, that we didn’t initiate, or which doesn’t follow your patterns of financial behavior.

- We have seen some of these attempts via DocuSign or other electronic document approval systems.

- We only use DocuSign and only via Schwab. Links from any other document approval systems are not from us/Schwab.

- We originate 100% of the DocuSign envelopes you get from Schwab. Schwab cannot do this on their own. And we will TELL YOU via email, text, or phone when we send you a DocuSign agreement via Schwab so that you know we sent it. If you have not heard from us, don’t open until or unless you confirm with us.

- Some Schwab documents from us are delivered via email link to your Schwab.com (Schwab alliance log in) rather than via DocuSign. But we will also TELL YOU via email, text or phone when we send a document this way so you know it is from us. For extra security, consider logging into your Schwab.com account vs using the email link.

- If you are not sure, call us right away.