Bernie’s Blog

New Year’s Resolutions

We all need more New Year’s resolutions, don’t we? We have tried to keep these simple and we will help you with these three! The “exercise more” and “lose weight” are up to you. We will help with “reduce stress” though.

1. Finish your 2018 Roth IRA contribution

Remember that you have until April 15, 2019 to make your 2018 contribution of up to $5500. When you send to Ameritrade, clearly indicate that this contribution is for 2018. Anything not clearly marked for 2018 will be applied to 2019. And if you have already made your 2018 contribution, go ahead and get started on 2019. The max contribution is $6000 for 2019. We can help with either or both contributions.

2. Reduce your mail volume from Ameritrade

Obviously you can continue to receive mail from Ameritrade if you desire. You can, however, choose to get your monthly statements and trade confirmations online instead. As always, your tax documents will be both mailed and available online. To change your document delivery options, go to www.advisorclient.com > Client Services> My Profile> User ID settings> Edit Communication Delivery Options. While you are at it, you can change your account nicknames so you actually know which accounts are which! Same basic instructions as above: My Profile> Account Settings> Edit Account Description. Remember that your transaction history and monthly statements are always available online for you to print as needed.

3. Update your beneficiaries and trusted contact with Ameritrade

Many of us have never added these in the first place, much less updated them as needed. As usual, there is an Ameritrade form required to do this, for your security obviously. We will work with you on this update as part of your Q1 or Q2 report.

Easy, huh? Nice when something is!

Happy 2019!

You Are Not Alone If You Are Concerned About the Market

It’s understandable to be concerned about the market right now. Political dysfunction is everywhere and it’s not clear when the “cooler heads” will prevail or who exactly those “cooler heads” are at the moment. The drop in stock prices in the last quarter has been sharp and across the board. Very few sectors or individual companies have been spared. The gains that were established earlier in the year have been erased. As you well know, we are nowhere near smart enough to predict when and where the bottom is. This has been painful for all investors, but we believe there is a real potential upside to much of the turmoil.

Most mutual funds have just declared and are in the process of paying their dividends and capital gain distributions for 2018. The value of these distributions is double and in some cases, triple the percentages from prior years. What this means is that at some time during 2018, the funds sold off shares in which they had recorded sizeable gains. We don’t know when this occurred during the year, but you as shareholders are receiving these proceeds. As most of you know, when a mutual fund pays a capital gain or dividend distribution, the share price of the fund declines by the amount of the distribution and then the next day, you receive that same amount in either cash or in additional shares of the fund. Most of you are reinvesting the cash automatically in additional shares of the funds. These funds are likely now sitting on large amounts of cash. That is the position that you want to be in; lots of cash to invest as prices are falling. The funds we recommend for our clients are managed by very smart people and you have seen that over the years. Will they be perfect in timing when to reinvest this cash? Probably not, but they will be smarter than we, as individual investors, trying to time the market would be. That is why we are recommending that almost all of our clients maintain their holdings and wait for the furor to subside. It will, maybe not next month or even next quarter, but there really will be positive outcomes after all of the turmoil.

Our best advice: Enjoy the holidays with your families and appreciate our many blessings!

Best wishes for a Merry Christmas, and a Happy, HEALTHY 2019!

Bernie, Lori, and Marci

Holiday Gift Idea #2 for Children or Grandchildren

As promised, it’s Lori back again to re-introduce you to Roth IRA’s, but this time, as great financial gifts for your lucky and hard-working children or grandchildren. As I said earlier in the month, there are very few investments which grow tax free but 529 plans and Roth IRA’s do just that!

Many of you are familiar with Roth IRA’s, but for those of you that are not, here is a brief overview:

Roth IRA’s were created by the Taxpayer Relief Act of 1997 to help Americans save for retirement. These IRA’s have become enormously popular in the last 20 years but there are some important considerations:

- The dollar contribution limits are the same for Roth IRA’s and traditional IRA’s. Eligibility for a Roth IRA requires “earned income,” subject to an income cap which is not present for traditional IRA’s.

- Contributions are made with after-tax dollars, unlike those in traditional IRA’s or most company sponsored retirement plans.

- Because the contributions are made with after-tax dollars, the contributions can be withdrawn at any time, without tax or penalty. This might be important for young investors like your children or grandchildren who might need the money they invested before retirement.

- Unlike traditional retirement plans, the earnings can also be withdrawn tax-free, subject to owner age and account duration rules, and there is no requirement for distributions to begin at 70½ years of age.

As I said above, there is a requirement for the Roth IRA account holder to have “earned income” in order to be able to contribute BUT the actual contribution can be funded by anyone (YOU in this case) as long as the dollar amount of the contribution does not exceed the owner’s earned income or annual maximum allowed.

Head spinning? How about an example? You have a 19 year old grandson who worked over the summer as a lifeguard at a community pool. He earned $2000 and will receive a W-2 from the city. I am guessing he probably can’t invest this $2000 in a Roth IRA because he is saving every penny for college, BUT you can fund it for him. You have until April 2019 to make this 2018 Roth contribution. We will help you understand eligibility requirements and then help you actually pull this off.

Want to read more about Roth IRA’s? See attached link. https://www.investopedia.com/terms/r/rothira.asp

Holiday Gift Idea #1 for Children or Grandchildren

It’s Lori blogging in December to share our thoughts on great holiday financial gifts for your children and/or grandchildren. This post will cover 529 educational plans and the next one will re-introduce many of you to Roth IRAs. By the way, we are not suggesting that you forego fun gifts for your offspring, but we really like the idea of longer term not nearly as “fun” gifts to help secure the financial futures of your lucky family members.

As many of you know, there are very few investments which grow tax free but 529 plans and Roth IRAs do just that.

529 plans are state run educational savings plans which can be used for very broadly defined educational expenses for adults or children. Starting this year, these funds can be used for pre-college, trade school, or college tuition/fees. The investments in a 529 plan can be made by anyone, subject to gift tax requirements, and are made with after-tax dollars although some states offer a state tax credit to parents who contribute in their state of residence (North Carolina does not offer this credit at this time). The funds in a 529 plan can be moved to another child and the funds do not have to be used in the state in which the plan was funded. Unlike other investments, 529 plans are controlled by the account “owner”, not by the child. Taxes and penalties are due if money is not used for educational expenses, but again, the definition of educational expenses is quite broad and usually includes computers, books and room and board.

These plans carry low management fees because they tend to be “target date” funds where the investment mix is automatically re-balanced as the child gets closer to college age.

Although 529 plans are not LFS managed assets, we would be happy to assist you in starting one for your children or grandchildren, or even for yourself! There is no minimum dollar requirement to open an account and dollars can be added throughout the year.

If you want to read up, see link below, or feel free to call us to talk more.

Lots of news from our Atlanta LFS Office!

Hi everyone. It’s Lori blogging today from our Atlanta LFS office. I just want to share a few quick updates and an invitation for all of you.

First (and most important if you ask me!) is that after 250 grueling study hours, I have just passed the Series 65 investment advisory licensing exam and am now a registered investment adviser along with my dad Bernie and sister Marci. You will get formal notification in Q1 but I just wanted to share the good news now.

Although Marci has been working out of our new office in Atlanta since January and I joined her in June, we haven’t had an Open House yet to show off our new digs. We never want to pass up the opportunity to celebrate good news, and since the market isn’t providing much these days, we are throwing ourselves a party!

The Atlanta clients have already been formally invited, but if anyone else is looking for an excuse to visit Atlanta, we would love to have you too. Just let us know!

Date: Sunday December 9

Time: 4 to 7 pm (drop in)

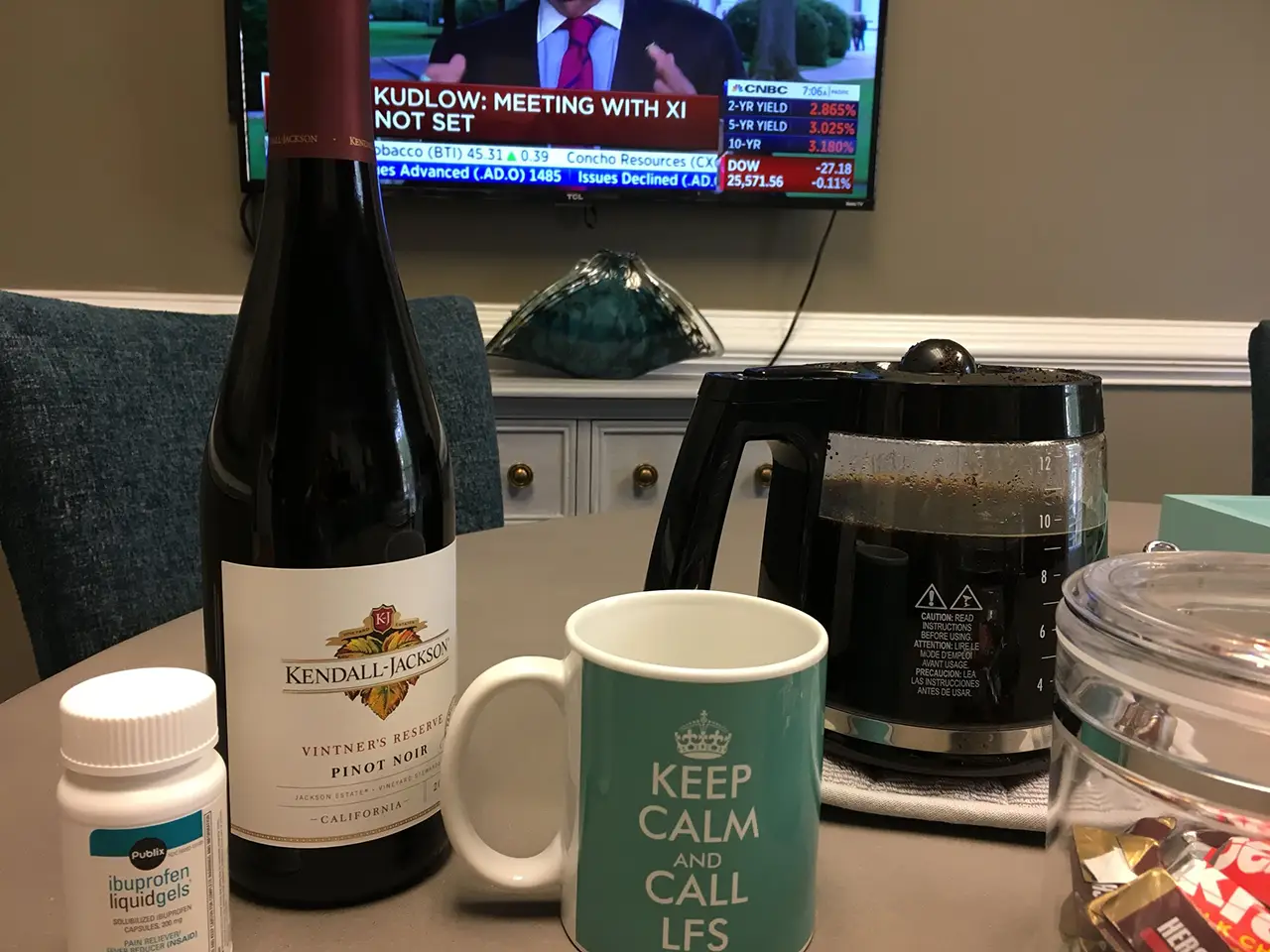

Feeling queasy today? We’re here for you!