Bernie’s Blog

Merry Christmas and Happy Hanukkah!

Schwab to Acquire TD Ameritrade

As many of you have noted, it is likely that Schwab will be acquiring TD Ameritrade, which is the current custodian for our client accounts. If the deal goes through, the effective date will likely be sometime in the second half of 2020.

The obvious question is what this means for all of us. And the obvious answer is that we do not know yet. Our objective will be to make this potential transition as seamless as possible for all of you! And of course, we would love to get more responsive, more error-free service from Schwab. We will see about that part.

The good news is that we, and many of you, have been through this before. The bad news is that we, and many of you, have been through this before.

Feel free to call with questions or whining about this news. We are doing same.

Lori

ATTENTION: Synchrony Bank Customers

We know a lot of you have high yield saving accounts and/or money markets at Synchrony.

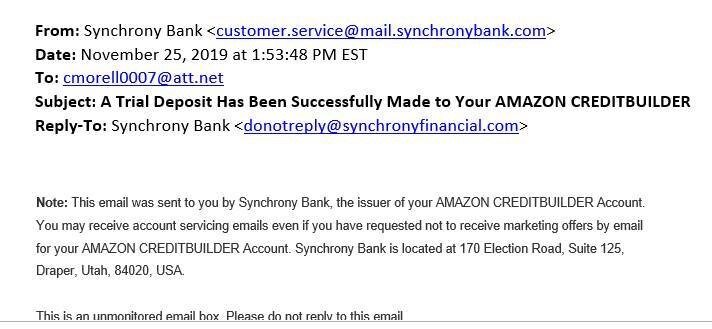

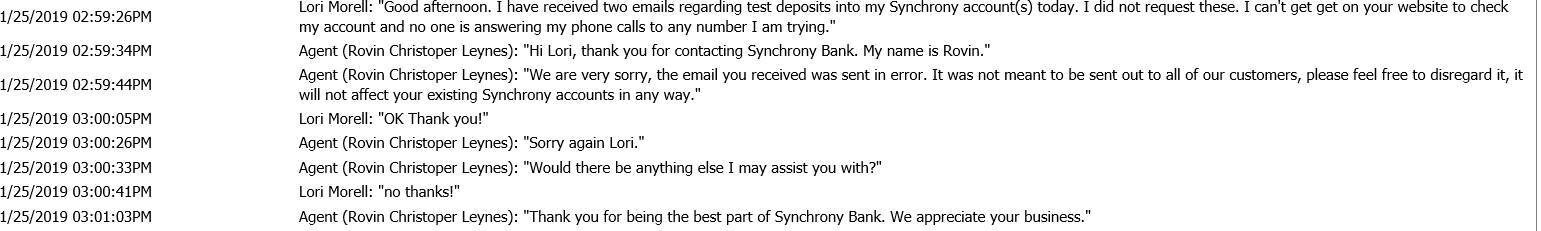

Synchrony had a very bad day on Monday and accidentally sent emails to many customers regarding trial deposit into their Synchrony accounts or Amazon Creditbuilder accounts. This was absolutely an error and Synchrony has assured me that all accounts are safe.

Here is what the emails looked like and Synchrony’s response, when I finally got through. I have since received another email on another topic. All the phone lines and website are out of service right now due to very high volume – which isn’t helping.

As usual when there is a problem of any type, I recommend that you change your Synchrony password once you can get back into your account.

Holiday Gift Idea for Children or Grandchildren

Back, by popular demand, is our December 2018 post on Roth IRA’s as holiday gifts for children or grandchildren. Still a great idea!!!

Many of you are familiar with Roth IRA’s, but for those of you that are not, here is a brief overview:

Roth IRA’s were created by the Taxpayer Relief Act of 1997 to help Americans save for retirement. These IRA’s have become enormously popular in the last 20 years but there are some important considerations:

- The dollar contribution limits are the same for Roth IRA’s and traditional IRA’s. Eligibility for a Roth IRA requires “earned income,” subject to an income cap which is not present for traditional IRA’s.

- Contributions are made with after-tax dollars, unlike those in traditional IRA’s or most company sponsored retirement plans

- Because the contributions are made with after-tax dollars, the contributions can be withdrawn at any time, without tax or penalty. This might be important for young investors like your children or grandchildren who might need the money they invested before retirement

- Unlike traditional retirement plans, the earnings can also be withdrawn tax-free, subject to owner age and account duration rules, and there is no requirement for distributions to begin at 70 ½ years of age

As I said above, there is a requirement for the Roth IRA account holder to have “earned income” in order to be able to contribute BUT the actual contribution can be funded by anyone (YOU in this case) as long as the dollar amount of the contribution does not exceed the owner’s earned income or annual maximum allowed.

Head spinning? How about an example? You have a 19 year old grandson who worked over the summer as a lifeguard at a community pool. He earned $2000 and will receive a W-2 from the city. I am guessing he probably can’t invest this $2000 in a Roth IRA because he is saving every penny for college, BUT you can fund it for him. You have until April 2020 to make this 2019 Roth contribution. We will help you understand eligibility requirements and then help you actually pull this off.

Want to read more about Roth IRA’s? See attached link. https://www.investopedia.com/terms/r/rothira.asp

Phishing Anyone?

As part of our normal security training and review, we tested ourselves on our ability to spot phishing emails. We will give you an option below to check your own capability too! (The test is hard. I have had phishing training at least three times and I still didn’t pass the first time)

So just what is phishing?

Phishing is the fraudulent practice of trying to obtain financial or other confidential information via the Internet by sending users a fake email which looks like it has been sent by a legitimate organization but which contains a link to a fake website which looks like the real one. The confidential information entered by the user on the fake website is then used to steal money or confidential information. Scammers phish because it’s easy to do, there are no geographic limitations and it works! Phishing is also often done via a fake link sent by text message.

How do I know if an email is phishing?

- There is a link inviting you to update or confirm information, usually urgently. Often the email will indicate that your account is “on hold”

- The greeting is generic

- There are typo’s or grammar mistakes

- The email looks legitimate and it’s from a company you do business with

- It offers some refund or prize you have not requested

What can I do to reduce the chances of being caught in a phishing net?

- Use security software on your computer and apply security patches when they are pushed to you

- Automatically update your phone with security upgrades

- Use multi-factor authentication where it is available

- Back up electronic data – to external drive

- Do not click on links in emails unless you are sure they are legitimate. Use other means to contact the company.

What should I do if I am caught in a phishing net?

- If you think you have revealed confidential info, contact IdentityTheft.gov

- Run a security scan on your computer and update your security software if needed

- Change relevant passwords using legitimate website, not email link

- Report the scam to the real website owner

- Help others avoid the scammers:

- If you got a phishing email or text message, report it. The information you give can help fight the scammers.

- Step 1. If you got a phishing email, forward it to the FTC at spam@uce.gov and to the Anti-Phishing Working Group at reportphishing@apwg.org. If you got a phishing text message, forward it to SPAM (7726).

- Step 2. Report the phishing attack to the FTC at ftc.gov/complaint.

- If you got a phishing email or text message, report it. The information you give can help fight the scammers.

Learn more here: https://www.consumer.ftc.gov/articles/how-recognize-and-avoid-phishing-scams

Take the test yourself: https://www.phishingbox.com/phishing-test

Sharing Vanguard’s perspective on “staying the course” (1 of 2)

Vanguard has recently provided a few interesting pieces which reinforce the importance of “staying the course” when the market is volatile. This isn’t ancient history, unfortunately.

As always, we are here to talk if/when you are nervous.

Compliments of Vanguard…..https://advisors.vanguard.com/iwe/pdf/FAMKTVOL.pdf