Bernie’s Blog

Oil, Oil and More Oil… Part 2

Hi everyone. This is Bradley again with the rest of my BLOG post on oil. As promised, I want to share what has happened to oil prices in 2020 and even more importantly, why we all care about that!

Although Russia is not officially part of OPEC, it has generally cooperated in their supply agreements. Since 2017, OPEC and Russia have consistently tried to cut their production to maintain high oil prices. However, this deal came to a head in early March 2020. In the midst of probable decreases in oil demand due to economic slowdown related to COVID-19, OPEC demanded that Russia cut its oil production further. Russia refused, and in response Saudi Arabia (the world’s largest producer of oil) flooded the world market with oil. Thus, oil prices in the world collapsed (Brent crude dropped from $45/barrel to $30/barrel overnight and is now trading at $26/barrel.) Oil prices actually went negative briefly in late April as oil storage tanks were used up due to a lack of customer demand.

Now, what does this mean for us? Most obviously, it will cause a decrease in gasoline prices at the pump. US oil producers may be hurt significantly since many of them are not profitable with oil at current prices. Possibly prices of other products will decline as a result, but that will be difficult to determine with so many other factors involved.

Now for some input from LFS: What does this all mean to us? As consumers, it is clear that gas prices are lower; now if we only had somewhere to go. As investors, the collapse in oil has contributed in no small way to the market volatility we are experiencing. Are there investment opportunities here? Maybe – at least for the non-squeamish among us. And as global citizens, it’s clearly just another example of how interconnected we are.

Oil, Oil, and More Oil… Part 1

This is Bradley again, reporting in from “Safe-at-home” in Southern California…(I needed a break from thesis writing). This week, I’m going to stay far away from COVID-19 news (because we definitely get enough of that) and talk about the global oil markets, and some recent “interesting” events.

We are all at least passingly familiar with oil. Oil is a mixture of chemicals (specifically hydrocarbons) that are derived from decay of organic remains of ancient organisms. In the past several centuries, humans have figured out how to separate oil into different useful parts (a process called refining) including fuels (gasoline, diesel, methane), feedstocks for the chemical industry (ingredients for plastics, perfumes, and pharmaceuticals), and building materials (asphalt and tar). As a result, oil production, trade, and refining has become an essential part of the global market.

Because of petroleum’s important uses, a global trade in petroleum has developed. We’re probably all familiar with seeing pundits talking about the price of a “barrel” of oil. A barrel of oil is 42 gallons and is the primary trading unit in oil markets. There are many different kinds of oil that are traded in the global marketplace, but probably the two most common are Brent and WTI (West Texas Intermediate). Generally speaking, the differences between types of oil aren’t important financially (specifically they have different densities and quantities of sulfur) because they all produce fuels and other compounds after refining (that’s what we chemical engineers do). They generally move together in global markets, with Brent having a higher price than WTI.

Now, let’s finally talk about oil in the financial markets. Broadly speaking, oil prices move the same way as the economy. This is because when the economy is good, people buy more stuff (which often requires petroleum products to make and transport) and travel more (using more fuel), which increases the demand for petroleum products and thus the price. When the economy enters a recession, all things being equal, oil prices will decrease due to a decrease in aggregate demand.

However, the oil market is not a free market (at all), due to the presence of OPEC (organization of petroleum exporting countries) in the market. OPEC is a cartel made up of countries (and their state-owned petroleum companies) that produce much of the world’s oil, with the goal of maintaining high oil prices to maximize revenue. Important members of OPEC include Saudi Arabia, Venezuela, Nigeria, Iraq, and Iran. Historically, OPEC has had a great deal of control over global oil prices. However, recently due to technological advancements, the US (and to a lesser degree Canada) have diminished OPEC’s power due to development of shale oil resources. These resources significantly increased the supply of oil, resulting in lower prices and significant strife in OPEC which is no longer able to maintain their high prices.

Next up: What has happened to oil prices in 2020 and why it matters to us

Financial Literacy Month Feels Different This Year!

April almost got away from all of us without our very popular April Financial Literacy Quiz!

As a reminder, being financially literate means understanding how money is earned, saved and invested in order to make the best financial decisions for our own situations. Admittedly, all of this feels a bit surreal right now!

Research suggests that higher financial literacy has been clearly linked to responsible financial decisions to help us all

• Plan for our financial goals

• Avoid the highest cost debt

• Build an emergency fund AND earn higher interest on itFinancial Literacy Day on Capitol Hill has been canceled this year, although many recognize these skills are more critical than ever!

Because my questions last year were so easy, I went to my collection of hard questions to try to stump all of you this year. Multiple responses might be correct.

1. How much should my emergency fund be?

a. This is a silly question – enough to cover my emergencies of course

b. 3-6 months of average expenses

c. 2 years of average expenses

d. Whatever it needs to be so I can sleep at night

e. No idea. Need to call LFS.2. What is the biggest risk of owning long term bonds for capital preservation/safety?

a. Falling interest rates

b. Rising interest rate

c. Inflation

d. I have no idea since I am not interested in capital preservation/safety

e. No idea. Need to call LFS.3. If inflation is 2%, in what investment option am I most likely to lose purchasing power?

a. Stock market

b. Real estate

c. TIPs

d. Cash in multiple coffee cans scattered throughout my house to ensure adequate diversification

e. No idea. Need to call LFS.The CARES Act: Part 1

We hope all of you are healthy and at home as we begin the month of April. We are all working from home so don’t hesitate to continue to reach out!

We are all starting to study the new CARES Act so we want share what we have uncovered thus far. We have labelled this post as Part 1 because we are sure there will be more to come on this topic but let’s get started!

First of all CARES stands for Coronavirus Aid, Relief and Economic Security Act. The bill itself is over 800 pages long and has economic provisions for individuals, small and large businesses, state and local governments, public health and education/other.

There are implications for RETIREMENT PLANS which we want to summarize for you. These pieces apply to all, regardless of whether you have been impacted directly by the virus. There are other components of the Act which apply at this point only to those directly impacted.

RMDs (Required Minimum Distributions) have been suspended for 2020:

- This suspension includes inherited IRA’s

- There will be no penalty assessed if the distribution is eliminated in 2020

- Obviously the majority of retirees need this money for living expenses and will need to take the 2020 distribution anyway

If you have already taken your 2020 RMD, but don’t need the cash for living expenses in 2020:

- You have 60 days to return the dollars to a retirement account without paying the taxes

- We are not yet sure how Ameritrade will want to handle this transaction so let us know if you are interested in pursuing

- You can also convert this distribution to a Roth IRA and pay the taxes as you had planned. Again, call us if you are interested in doing this.

For those of you who aren’t subject to RMDs, but might want to take advantage of provisions in the CARES Act:

- The deadline for making 2019 contributions to an IRA of any type has been extended to July 15, 2020 to coincide with the federal tax filing deadline extension. We need to ensure that the contributions gets coded to the correct year so let us know if you want to do.

- Roth IRA Conversions are “on sale” right now. This is a great long term strategy for those of you who have traditional IRA’s and some cash. In short, if you convert a traditional IRA to a Roth IRA this year, you pay the taxes on the full amount you are converting in 2020, but then the Roth grows completely tax free forever – for you or your heirs. You can convert as much or as little as you would like so let us know if you want to discuss.

There are more provisions for additional distributions from IRA’s and loans/distributions from 401K’s. At this point, these pieces require proof of direct impact from the virus, including job loss. We can help work through these options with you if needed.

Again, most important thing is to stay healthy! We are here!

First Things First

As we all begin another chaotic week, we all know that your health and the health of all people around the world is far more important than the stock market, so let’s focus on that first. Once that is taken care of, the market will hopefully regain its health too.

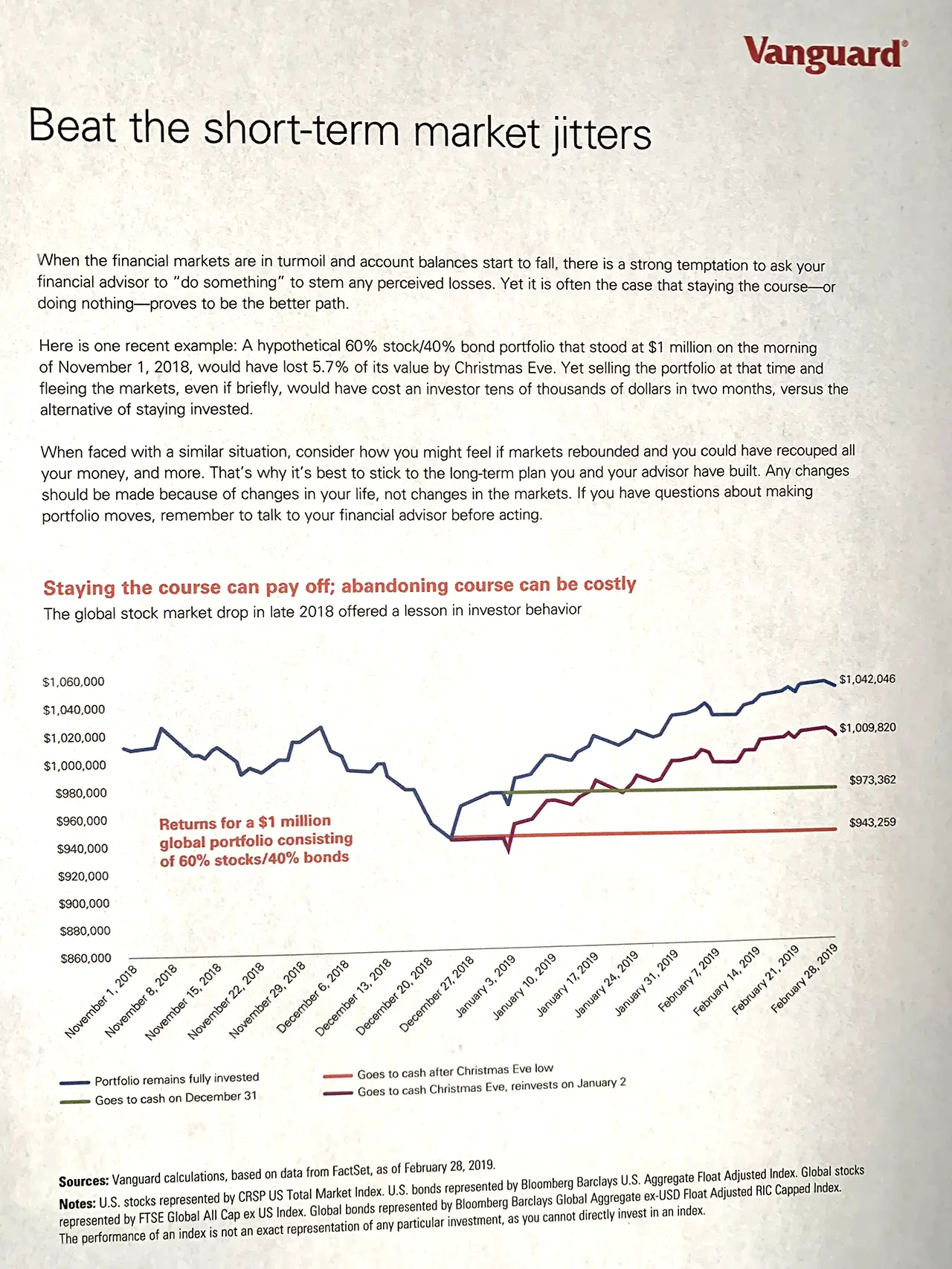

When you are ready for a distraction, we like this article from Vanguard which talks about the value of “staying the course” through market downturns.

But we also know it’s easy to say and hard to do!

We are here for you so if you are nervous or just want to catch up, don’t hesitate to call!

Market Uncertainty

Dear Clients,

As the new week and new month begin, we want to reach out to all of you who may be concerned about both your physical and financial well-being.

At this point, there is a tremendous amount of uncertainty regarding the spread of Coronavirus, the severity of the outbreak, and the duration. We are all relying on the expertise of the scientific and medical communities and we are fortunate that they are some of our country’s best and brightest.

The financial implications are also a huge unknown. While market corrections are inevitable, the speed at which this one occurred is dizzying, and there may well be more to come. The world has benefited from a global economy in which trade, travel, manufacturing, and research are shared across borders and oceans. The difficulty in containing a virus of this type is an obvious downside and the impact has grown as our economies have become more interdependent.

Concern about your investments is normal and expected. This situation is obviously particularly disconcerting because there is no financial, legislative, or political solution. Our advice during this time though, is the same as it has been during prior corrections. We do not recommend making changes to a portfolio based on fear, no matter how well justified that fear may be. Our view has been and remains that a long-term, well diversified portfolio will provide stronger returns over time, than attempting to time the market in response to the latest headlines.

That all being said, a reminder to all of you that we are here for you. If you want to talk about your specific concerns, please call or email, or come by the offices.

Marci, Lori, Tim, and Bernie